The Retiring FITT® System

How We Got Here

After years of listening to new clients, often teary eyed, sitting in our conference rooms explaining the deep frustration they feel about their bad retirement decisions, Sharon Duncan, president of Selah Financial, began formulating a system for how to streamline the retirement process. “By the time these folks came to us, they had already been listening to and heeding a lot of conflicting and bad advice from well-meaning family members, friends, sales people, and even their company’s human resource managers,” Sharon explained. The day the idea really began to solidify is easy for Sharon to remember because it was when one of Selah’s long-time clients, Bob, came in looking completely distraught. He explained his situation in detail, feelings spilling out about how he may have nothing to give his children later in life, and even fears that he may run out of money for him and his wife!

Bob’s situation reminded Sharon of her own experiences as a young mother with a sick child, in which she received so much conflicting information from family, friends and doctors that she was completely at a loss. Although her son is happy and healthy now, at the time, Sharon had to learn to become a case manager for his medical situation. Because of these combined experiences, Sharon’s “heart of a teacher” took over.

“I finally just had enough and decided to restructure our retirement process so that we could offer the help people needed earlier in the retirement game,” said Sharon. “We became Bob’s retiring case manager right there on the spot!” Since our team of veteran retirement specialists are well equipped to provide guidance and strategies, we were able to redirect Bob’s retirement.

This example is from an actual client experience and is for illustrative purposes only. Actual performance and results will vary. This example does not constitute a recommendation as to the suitability of any investment for any person or persons having circumstances similar to those portrayed, and a financial advisor should be consulted.

A Comprehensive Retirement Roadmap:

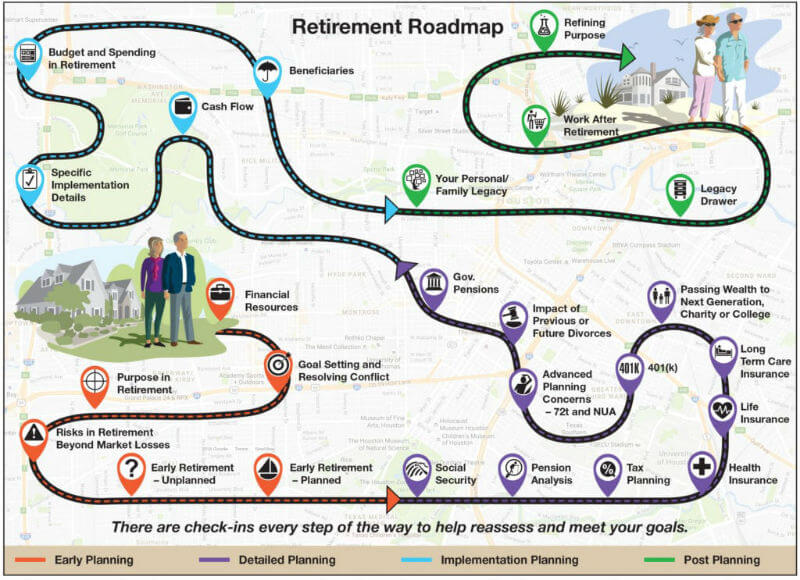

Retiring FITT ™ is Selah Financial’s proprietary system designed to empower retirees to make good decisions when going through the retirement process. Systematic and organized, Retiring FITT ™ looks at the entire picture and provides the missing pieces, helping alleviate fears of making critical and permanent mistakes. Retiring doesn’t have to be scary, overwhelming and confusing.

Rather than offering general, overly broad guidelines, or focusing on rollovers and insurance alone, Retiring FITT ™ allows you to consider all aspects of how retirement may impact your family’s financial health for decades to come. Retiring FITT ™ considers your personal data, timelines, pensions, Social Security funds, compensation plans, insurance, 401(k)s, and IRAs, but also addresses more comprehensive concerns such as purpose in retirement, philanthropy, legacy, budgeting, education, major purchases and more.

The system covers 25 different aspects of retirement and allows users, whether working with an advisor or doing it on your own, to develop a solid action plan.

By placing the power back in your hands and away from sales people, you will see the mystery behind retirement melt away. Aiming to provide you with financial independence today and tomorrow, Retiring FITT ™ takes you from the point where you’re dreaming about retirement all the way through the years following your official retirement.

The thing the Selah team loves most about Retiring FITT ™ is how it puts you, the investor, in the driver’s seat. We really believe this system is going to change the conversation about retirement across the country.

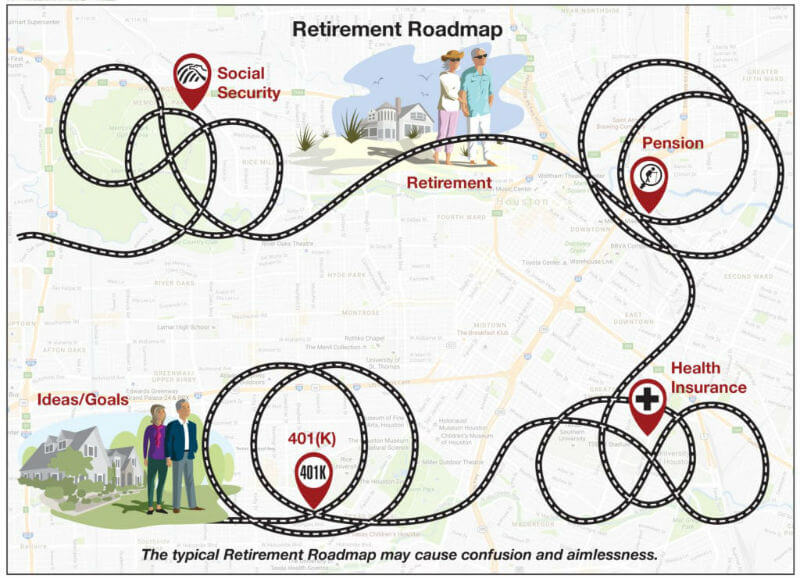

4 Typical Concerns

Some plans only focus on 401(k)s, Health Insurance, Pensions, and Social Security.

Retiring FITT ™ System

Selah’s Retiring FITT ™ System allows our advisors to explore 25 crucial retirement topics and options with you, including many that are often overlooked but just as important!

Retiring FITT ™ is a proprietary system designed to help ensure you have taken care of all your retirement details and decisions so that preparing for your retirement is not scary, overwhelming and confusing.

Contact Us

Contact Us By Appointment

Follow Us

This communication strictly intended for individuals residing in the states of AL, AZ, CA, CO, FL, GA, IA, ID, IL, IN, KS, LA, MD, MI, MN, MO, MS, NC, NJ, NM, OH, OK, PA, SC, TN, TX, WA, WV, WY. No offers may be made or accepted from any resident outside these states due to various state regulations and registration requirements regarding investment products and services. Investments are not FDIC- or NCUA-insured, are not guaranteed by a bank/financial institution, and are subject to risks, including possible loss of the principal invested. Securities and advisory services offered through Commonwealth Financial Network ®. Member FINRA , SIPC, a Registered Investment Advisor.

1550 W. Bay Area Blvd Suite #101 Friendswood, TX 77546 (281) 990-7100